Page 1 of 23

What Britishvolt’s Collapse Means for the Future of UK Innovation and Industry

When Britishvolt went bust in early 2023, many people were shocked. Here was a company that promised to bring thousands of jobs, help the UK lead the way in electric vehicles, and breathe new life into a proud industrial town. Instead, it ran out of money, construction stopped, and around 200 people lost their jobs […]

May 19, 2025

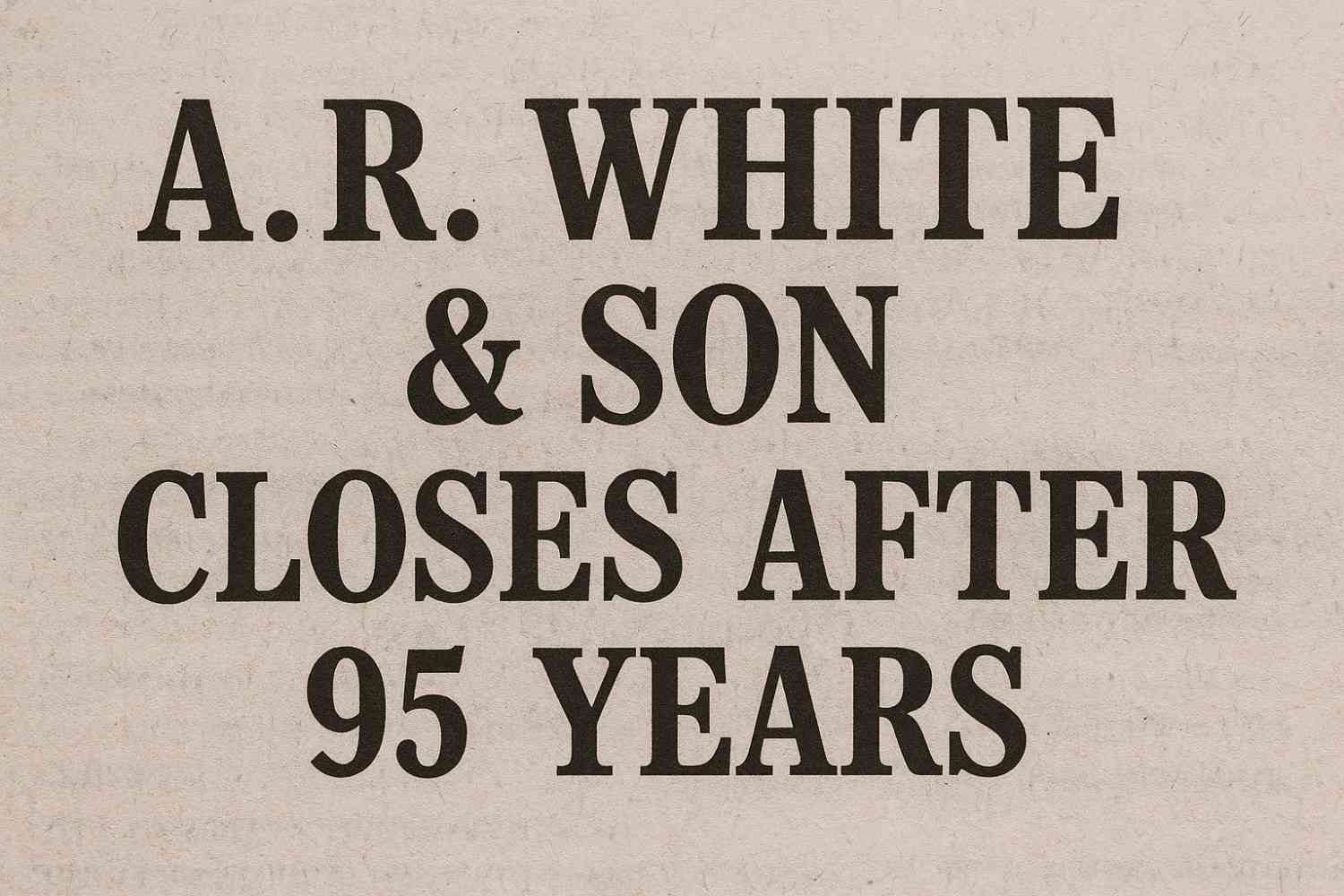

A.R. White & Son Closes After 95 Years of Menswear Excellence in Bilston

After 95 years of dressing the people of Bilston in top-quality suits and menswear, A.R. White & Son has announced it will be closing its doors for good in September 2025. The news has touched many people, as the shop has been a local favourite for nearly a century, offering exceptional service and tailored clothing […]

May 10, 2025

The Fate of Trademarks, Patents, and Copyrights in Corporate Insolvency

In corporate insolvency, the management and disposition of intangible assets like trademarks, patents, and copyrights are important considerations. These intellectual property (IP) rights often hold substantial value and can hugely influence the outcomes of insolvency proceedings. Understanding how these assets are managed during such times is essential for stakeholders, including business owners, creditors, and legal […]

May 1, 2025

Role of Administrators and Liquidators in Commercial Contracts

In business, there are times when a company encounters financial difficulties, potentially leading to insolvency. When this happens, administrators and liquidators play pivotal roles in managing the company’s affairs, particularly concerning commercial contracts. Understanding their responsibilities can be crucial for businesses, creditors, and suppliers. In this blog, we explore the role of administrators and liquidators […]

April 23, 2025

The Rise and Fall of MaxiDeals: Lessons from the Discount Retail Sector

The retail sector has always been fast-paced and competitive, with businesses constantly adapting to changing consumer trends and economic conditions. However, the rapid rise and subsequent fall of MaxiDeals, a once-prominent player in the UK discount retail sector, offers valuable lessons for business owners and consumers alike. MaxiDeals, once a household name offering unbeatable prices […]

April 15, 2025

Rights of Zero-Hour and Temporary Workers in an Insolvent Company

Financial distress can put businesses under immense pressure, making it difficult to meet financial obligations. When insolvency strikes, the impact ripples far beyond creditors and shareholders – it affects employees, too. Zero-hour and temporary workers, often seen as less permanent staff, still have legal rights that protect them in these situations. For both workers and […]

April 8, 2025

Impact of Gender Composition in Directorships on Insolvency Risk

The right board members can make or break a company’s success – shaping its resilience, strategy, and future growth. Among the various factors influencing business sustainability, gender composition in directorships has gained considerable attention. Numerous studies show that diverse boards are linked to improved decision-making, risk management, and financial performance, which can ultimately influence insolvency […]

April 1, 2025

Top 10 Predictions for UK Restructuring and Insolvency in 2025

The UK restructuring and insolvency sector is constantly shifting, presenting businesses with fresh challenges and opportunities. As we look to 2025, several key trends are emerging, shaping the future of insolvency practices and corporate restructuring. Understanding these shifts is essential for both businesses and advisors to avoid potential disruptions. This blog will explore the top […]

March 29, 2025

Caledonian Logistics Faces Administration After 25 Years of Operations

After a remarkable 25 years in the logistics industry, Caledonian Logistics finds itself in a precarious position, facing administration. Once a leader in its sector, the company has encountered significant financial challenges that led to this difficult decision. For businesses and individuals in the UK, this news is a stark reminder of how even the […]

March 25, 2025

The Rise and Fall of Stenn: How a $900 Million UK Trade Giant Collapsed Overnight

Stenn, a UK-based fintech once valued at $900 million and backed by major banks and private equity firms, collapsed in a matter of years, raising critical questions about the sustainability of the trade finance model, regulatory oversight, and the risks of high-profile financial ventures. The company’s rapid downfall stemmed from allegations of money laundering, suspicious […]

March 18, 2025

Page 1 of 23